If you’re confused about Annuity Insurance and types of Annuities, then this guide is for you with all the essential details.

You’ll get all the point-wise details through this article. So, we will try to cover all the things on this particular retirement fund strategy.

Table of Contents

What is Annuity Insurance?

An Annuity Insurance is a significant chain of periodic payment; it’s the contract between you and your Insurance Company. This plan plays a massive return in your retirement plan. It’s a fact that an Annuity is a regular source of financial income.

If you like to have the best return in the world of uncertainty, then an annuity can help you get the best return of all time. All the scheme of Annuity is considered as a form of Insurance, not an investment alternative.

It’s a huge source of a steady income. If you’re looking to have a constant return after retirement, an annuity would be the best-performing Insurance.

How Does Annuity Work?

It deals with a periodic payment; you have to pay an amount monthly, which will come as a massive return after your retirement over time.

The length of your payment period will determine the size of each of your returns.

5 Types of Annuity Insurance

There are different types of Annuity Insurance, in this article, we will discuss 5 different types of Annuities so that you can go with any of these Insurance plans.

#1 Immediate Annuity

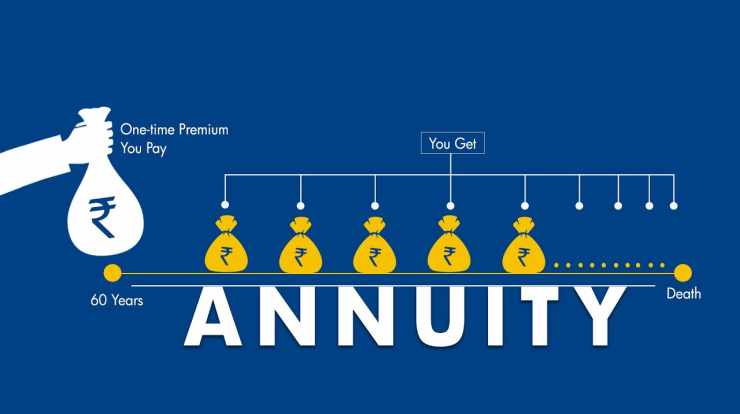

In Immediate Annuity, the premium is paid in a lump sum and no multiple numbers of times. With this Insurance plan, one will get a constant return with a regular interval of time. This investment plan is for those who will retire and looking to receive a constant return every month.

#2 Deferred Annuities

Deferred Annuity Insurance deals with building a corpus over time, which will be used to purchase an annuity at the time of retirement. Most of the Insurance Company offers this specific plan to investors.

#3 Fixed Annuities

Fixed Annuity is a great plan that deals with the same payout after retirement. It does not deal with the rate of interest. If you like to have a fixed income source, then go with this fantastic Insurance plan.

#4 Variable Annuities

Variable Annuity Insurances deals with a variety of annuity payout. This could be different over time, one return could be more, and the next month’s return could be less. So, this indirectly depends on the rate of Interest and surrounding factors.

#5 Lump Sum Annuity Insurance

Most of the Annuity depends on regular payment. But, this lump sum Annuity helps get a massive return at a time, after the retirement period.

Closing Opinion

An Annuity Insurance is a great Insurance plan; if you’re worried about the money after retirement, then Annuity will help you get a heavy return on your Investment. Through this guide, we have provided the Types of Annuities. Now, make a heavy investment on this and get a massive return for sure!