Everyone needs sufficient funds to enjoy their retirement. And if your employer is offering you a 401(k), it may not be enough to live the life of your dreams. This is where an individual retirement account (IRA) comes in.

An IRA boosts your chances of retiring with enough funds and there are different types, depending on what you want. You can click here to learn about the types of IRAs available. Nowadays, investing in precious metals such as gold and silver is a great way to grow your wealth and reduce your risks. You can invest in precious metals through a precious metal IRA.

Various institutions such as Augusta Precious Metals offer precious metals IRAs. So before you choose one, you need to review and compare them critically. Keep reading to find the key features of a gold IRA company.

Table of Contents

Augusta Gold IRA Reviews

When reviewing a Gold IRA, there are several things to consider. This will help you to know whether the company is good for you or not.

The Company’s Reputation

Investing is no joke; you’re converting your money into tangible assets. Hence, the company that handles this task on your behalf must have a good reputation. According to the IRS standard for IRA gold investments, a custodian must purchase the precious metals for you. So, you should know how long the company has been in existence before trusting it with your money.

You can check the company’s rating on websites like the BBB (Better Business Bureau), Consumer Report, and Trustpilot. For instance, a company with an A rating signifies that it delivers on its promise. Another thing you should do is read gold IRA company reviews to see what previous customers have to say about the company.

Set Up Fees

A gold IRA attracts more fees than other types of retirement accounts because it is a special account. But you should understand that the fees differ from company to company. Most companies charge a flat fee per annum while others charge based on your account balance.

For example, you invested $200,000 and the company charges a flat fee of about $300 yearly. You will pay lower than if the fees were placed according to account balances. Additionally, find out whether there are hidden fees to avoid surprises and spending more than budgeted.

Available Metals

Apart from gold, you can invest in silver, platinum, and palladium. But do not assume that every company offers all four metals. A company might offer only silver and gold. So, if you want palladium and platinum, you should look elsewhere.

In addition, the IRS has purity standards that determine whether a metal is investment grade or not. It also permits some gold coins like the Canadian Maple and American Eagle. The IRA Company should be conversant with the latest IRS regulations for individual retirement accounts. You can visit https://www.forbes.com/ to find out the IRA-approved precious metals.

Customer Service

Customer service is an integral aspect of every business. As a customer, you should be able to contact a service provider when you need assistance. Even if you’re an experienced investor, you can’t do everything by yourself. So, you should find out whether the IRA Company you want to invest with can deliver timely and relevant help when needed.

Some companies have customer care representatives that assist over the phone. Others assign a particular staff member to you. Whenever you need help, you can contact that person directly instead of waiting on the phone for an agent to attend to you. You can also contact your IRA provider via email or live chat.

How Does a Gold IRA Work?

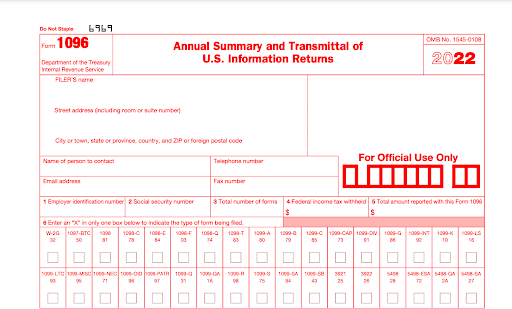

Before you can add physical gold to your investment portfolio, you must open a self-directed individual retirement account. It is the only type of IRA that permits the purchase of precious metals, cryptocurrency, real estate, and other hard assets. To operate the account, you need a custodian. That is, a bank or a financial institution that will set up the account, purchase the assets, send reports to the IRS, and handle distributions whenever you want to liquidate your assets.

A self-directed IRA is also called a gold IRA. You can fund the account for the first time by transferring money directly or rolling over funds from your other retirement accounts such as 401(k), 457(b), and 403(b). Subsequently, you can contribute a total of $6000 annually or $7000 if you are 50 years or older. The extra amount is for a catch-up.

After funding the account, you will select your preferred metals and then the custodian will make the purchase. Sometimes, custodians already have a list of trusted bullion dealers that they do business with but if this option is not available, you have to look for one. The custodian will also recommend a depository for storing your assets.

You can withdraw your assets at any time. But if you do so before attaining fifty-nine and a half years, you will pay 10 percent of the funds as a penalty. However, there are exemptions to the rule. You may want to read this article to know how to withdraw without a penalty.

Advantages of Opening a Gold IRA

Here’s why you should open a gold individual retirement account:

An Avenue to Grow Your Wealth

The value of gold appreciates over time. So, if you invest in the metal, you are securing the value of your money. Even if your country is experiencing inflation, it does not affect your money because it is tied to gold.

Assuming you purchased an ounce of gold at $380 in 1995 and by 2022, it is worth $1900. You have succeeded in growing your money as well as keeping it away from inflation rates. On the contrary, if you saved that $380 in the bank, the inflation rate as well as bank charges would have reduced it to almost nothing. Even if the money was untouched, that amount can’t sustain you in retirement in today’s economy.

A Means of Protecting Your Wealth

In addition to growing your wealth, a self-directed IRA helps to secure it. We are already familiar with the rising and falling of stocks. So, if you invest only in stocks, when there is a crash in the market, all your money will grow wings and fly away. Also, if your retirement falls within a period of economic crisis, you will sell your assets at a ridiculous price.

However, if you add gold to your stocks, mutual funds, and bonds, you are safe because when the prices of paper assets fall, the price of gold climbs. As a result, gold serves as a hedge. The financial situation of your country will not reduce its value.

Gold helps to balance or diversify your portfolio when other investments are hitting rock bottom. Unlike paper currencies, your money will not be devalued because it is invested in gold. Also, you can comfortably take care of needs in retirement when you liquidate your assets.

The Bottom Line

Now that you’ve read this article, you can confidently choose a gold IRA company. We discussed the important features that you should consider: the company’s reputation, fees, available metals, and customer care. We also discussed how the account works and the benefits of owning one.

It is important to know that gold investments are risky just like other investments. Therefore, the metal should be used for portfolio diversification, not as a sole investment.