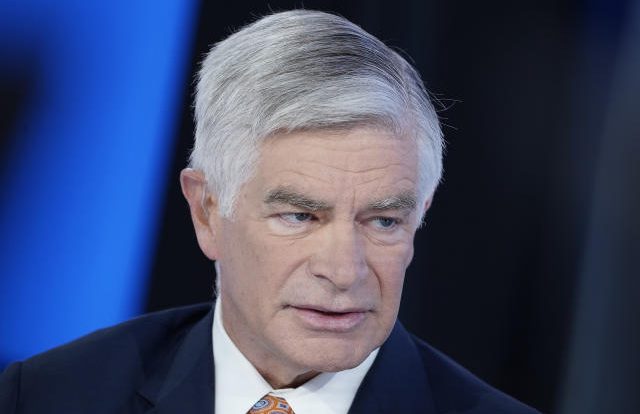

Philadelphia Federal Reserve President Patrick Harker advised Thursday that restoring economy additionally quickly could have grave results.

The national bank official introduced two circumstances:

The “more confident” one where it is restoring economy in June, there is abundant advancement to control the coronavirus spread and there is no feared second wave in the fall. Taking everything into account, he sees a much-expected genuine pressure in the resulting quarter followed by a “critical ricochet back” in the second an enormous bit of that is in any case inadequate to fix the mischief in the earlier bit of the year.

In the resulting circumstance, the economy opens too quickly, an ensuing wave comes through and the downturn is increasingly lamentable.

“Notwithstanding the way this would be a prosperity disaster, yet it would pivot the recovery too. In this less sure circumstance, I envision a similar advancement route to the standard for 2020, trailed by a horrifying money related withdrawal of GDP in 2021 as lockdowns are reintroduced,” Harker said in orchestrated remarks for a prologue to the Chicago Council on Global Affairs.

He talked as very nearly an enormous segment of the nation’s economy was being restarted resulting to being shut down since mid-March.

Harker saw that the current break was exacerbated extraordinarily by the social expelling approaches expected to control the coronavirus spread. In any case, he said purchasers recently had begun to ration up to this time, indicating that a bob back could take extra time.

He and his partners have realized an arrangement of measures during the crisis, from taking transient rates to zero to a movement of crediting and liquidity programs got ready for supporting markets and the economy.

Harker concentrated on that the uncapped security buying in which the Fed is associating with should not be seen as quantitative encouraging, in any occasion as to the undertakings the national bank endeavored during the money related crisis to drive budgetary experts into increasingly perilous assets like stocks and corporate protections.

“We’re not in 2009 any more and this isn’t quantitative encouraging 2.0,” he said. “The standard behind quantitative encouraging was that people weren’t partaking in adventures in light of the fact that the cost of capital was unreasonably high. That is simply not the case now. The clarification people aren’t interfacing financially is the prosperity crisis.”

Or maybe, he said the Fed is in “rescue” mode and that further quick portions that are required for individuals ought to begin from Congress.

Source of News: CNBC

Also Read: Tax relief likely on forced residency due to coronavirus lockdown