Stocks fell on Wednesday as financial specialists pondered downbeat comments from the top-positioning Federal Reserve official alongside stresses over the market’s valuation.

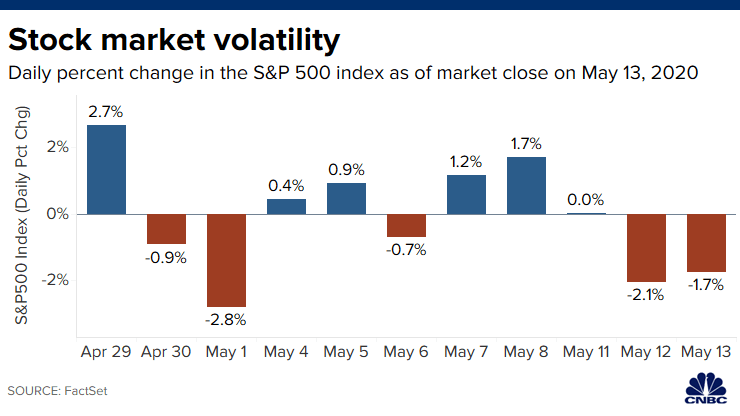

The Dow Jones Industrial Average dropped 516.81 focuses, or 2.1%, to 23,247.97. The 30-stock normal had its most noticeably terrible day since May 1. The S&P 500 shut 1.8% lower at 2,820 while the Nasdaq Composite fell 1.6% to 8,863.17. The tech-substantial file likewise a fell go into negative area for 2020 after Wednesday’s decrease.

Taken care of Chairman Jerome Powell said that all the more should be done to help the economy.

“While the monetary reaction has been both opportune and suitably huge, it may not be the last part, given that the way forward is both profoundly dubious and subject to critical drawback dangers,” he said. Powell included, be that as it may, the economy should see a generous recuperation once the coronavirus is leveled out.

Powell’s comments came after the Labor Department announced a week ago that a record 20.5 million positions were lost in April. They likewise come as a few states start reviving their economies, raising worry among specialists about the capability of a second flood of coronavirus cases.

“Everything is reliant on the following a while and how effective organizations can re-open,” Nick Raich, CEO of The Earnings Scout, wrote in a note. “All the boost on the planet won’t balance organizations shutting their entryways for an all-inclusive time.”

The significant midpoints were likewise under tension after extremely rich person financial specialist David Tepper considered this market the second-most exaggerated he’s at any point seen.

“The market is entirely high and the Fed has placed a great deal of cash in here,” Tepper, originator of Appaloosa Management, told CNBC’s “Halftime Report.” “There’s been diverse misallocation of capital in the business sectors. Unquestionably you are seeing pockets of that now in the financial exchange. The market is by anyone’s standard truly full.”

Walgreens Boots Alliance and American Express were the most exceedingly terrible performing stocks in the Dow, falling at any rate 5.4% each. Vitality and financials drove the S&P 500 lower by falling 4.4% and 3%, individually. Bank of America and Citigroup both dropped over 4% while Wells Fargo shut 6.3% lower. JPMorgan Chase fell 3.5%.

Journey line stocks Carnival, Royal Caribbean and Norwegian Cruise Line all fell at any rate 5%. Those stocks are among those that would profit by the economy reviving. Carrier stocks arrived at a new low for the emergency, with American Airlines falling 5.6% while Delta slid 7.7%. Joined Airlines Stock fell 9%.

News Source: CNBC

Also Read: Legendary investor Stanley Druckenmiller says He doesn’t like the way the Market is set up