Sometimes you want to buy a home and don’t have a large amount to pay off for the biggest purchase. You will surely think of borrowing money. Whether you are buying a house or any rental property, there are high chances that you will approach a mortgage loan that will let you borrow a large amount and pay it back with the lowest interest rates and for a flexible time.

When one thinks of involving in such a huge financial commitment, he knows that this process cannot be carried out alone. He needs some party who can lend or in some cases a third party who helps him get this process done.

It is not easy to just simply go to the lender, put in an application and it is all set. One of the easiest ways to get a helping hand is to use services from a mortgage broker, who sets up suggestions and advice on picking out the right option. Here are five top benefits of using mortgage broker services.

Table of Contents

You Will Get A Wide Range Of Options

In many cases, you face situations where you don’t have access to wide options to pick the most convenient one from among them to make the payment process more convenient. Mortgage brokers assist you in finding far-flung resources of mortgage loans from different lenders. Brokers who have broad experience and a greater network present better opportunities to obtain the loan and payment options that best suit your budget.

You Will Get Financial Expert’s Advice

When you hire a service provider, he must care for you and your needs. He is on your side. When you decide to get a big loan, a mortgage broker will help you drive through the path smoothly and handle the process on your behalf. You will have an expert who will give you sincere advice and create a favorable advantage for you.

You Won’t Need To Handle The Process

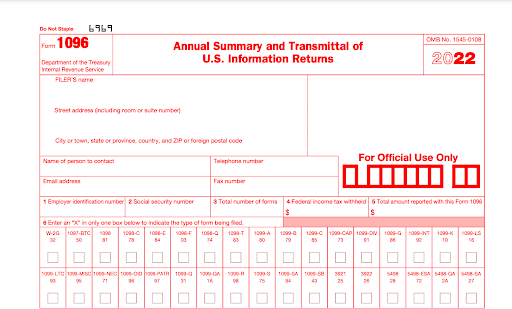

Along with giving you the best advice for picking the right option for you, a mortgage broker handles the application process and complete paperwork, and keeps informing you about the progress.

You Will Save Time

When you come out and start finding the best loan provider for borrowing, you need to do a lot of market research. Once you find the right option for you, you need to go through a long process of scheduling your meeting with lenders and negotiating on the terms when explaining your budget requirements, starting the process, and keep visiting them until the process is complete. All these arrangements need your time. Hiring a mortgage broker will save you time as he will already know the market and have a prepared file of lenders. The only thing you have to do is select a good deal.

You Will Save Money

When you hire a broker, not only he saves you time but saves you money as well. He is right there to take care of choosing the right deal which can meet your budget needs. He is going to negotiate on financial terms with lenders and try to make the payment plan more easy and convenient for you.

Conclusion

Research in the real estate market is quite difficult if you do not know how this market works and what average rates are being offered by state owners in fulfilling your demands. For the borrowing process especially, you need to consider hiring a professional mortgage broker who can make things easy for you so the whole thing does not become a pain in your head.