If you’re a small business owner, it’s more likely you have come across the 1099-NEC form. Now, if you prefer physically sending your returns (rather than electronic filing), you will have to use form 1096. It also applies to all businesses physically mailing the return forms, e.g., form 3922, 5498, W-2G, 1097, 1098, 1099, or form 3921.

Form 1096 is the cover sheet that summarizes all your business returns information to the IRS. It’s basically what the Internal Revenue Service (IRS) uses to categorize your return forms when you choose to mail the documents.

About Form 1096:

- What does it look like?

- How many Form 1096s do I have to file?

- Who has to file IRS Form 1096?

- How do I fill it?

- Do you include it when filing electronically?

Read to find out

Table of Contents

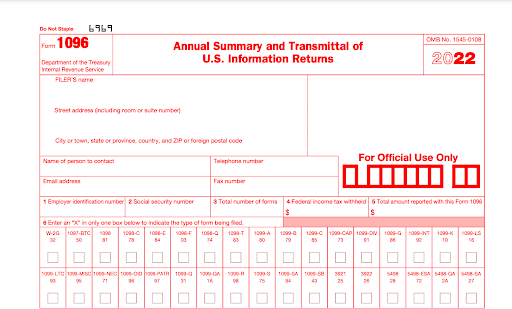

What Does Form 1096 Look Like?

The form has six filling boxes which you can categorize into two sections;

- Box 1 to 5: business and the representatives’ details, e.g., name, address, email, etc. employer identification number, social security code (box 2), the total number of forms (box 3), federal income tax withheld (4), and the total amount reported with the form (5)

- Box 6 includes a list of the return forms, 1097, 1098, 1099, etc. In this section, you are only to indicate with an ‘X’ the form type you are filing.

Below is a sample of how form 1096 looks like

How Many Form 1096s Do I Have to File?

Can I use the same Form 1096 for multiple form types? It’s a common question among garden-fresh entrepreneurs, and the answer is NO; you can’t use the same transmittal form for multiple IRS forms.

Each IRS form will need a 1096 transmittal form.

If you look keenly at Form 1096, you will note in box six you are to enter ONLY ONE ‘x’ to specify the return form. Therefore, if you are filing two forms (e.g., form 1099 and 1099), you will have to complete two F-1096 for each.

The same applies even when transmitting two forms under the same parent form, for example, Form 1099 NEC and 1099 MISC.

Who Has to File IRS Form 1096?

ALL businesses submitting their annual information return forms on paper MUST make their filings with the IRS Form 1096; it’s necessary. In addition, remember if you are filing different forms, each filing should have its own F-1096 cover sheet.

However, if you prefer the FIRE alternative (Filing Information Returns Electronically), you don’t need the IRS 1096 form. So, to answer the question, do you include Form 1096 when filing electronically? The answer is no; you don’t need to have it when electronically filing your returns.

How Do I Fill Out Form 1096?

You will need the following details to fill out Form 1096;

-

- Your employer identification number (EIN) or your social security number

- The total number of the forms returning. Follow the link, what is Form 1096, to see what shouldn’t be counted

- You will also need to calculate the federal income tax withheld and, lastly

- The total amount you are reporting

Fill in the above information in the Form 1096 box, sections one to five. Then indicate in section six the type of return paper you are filing; is it a 5498 or a W-2G form? Mark with an ‘X.’

There you have it now, some of the things you need to know about Form 1096.